The 50/30/20 Rule - Your Ticket To Financial Freedom

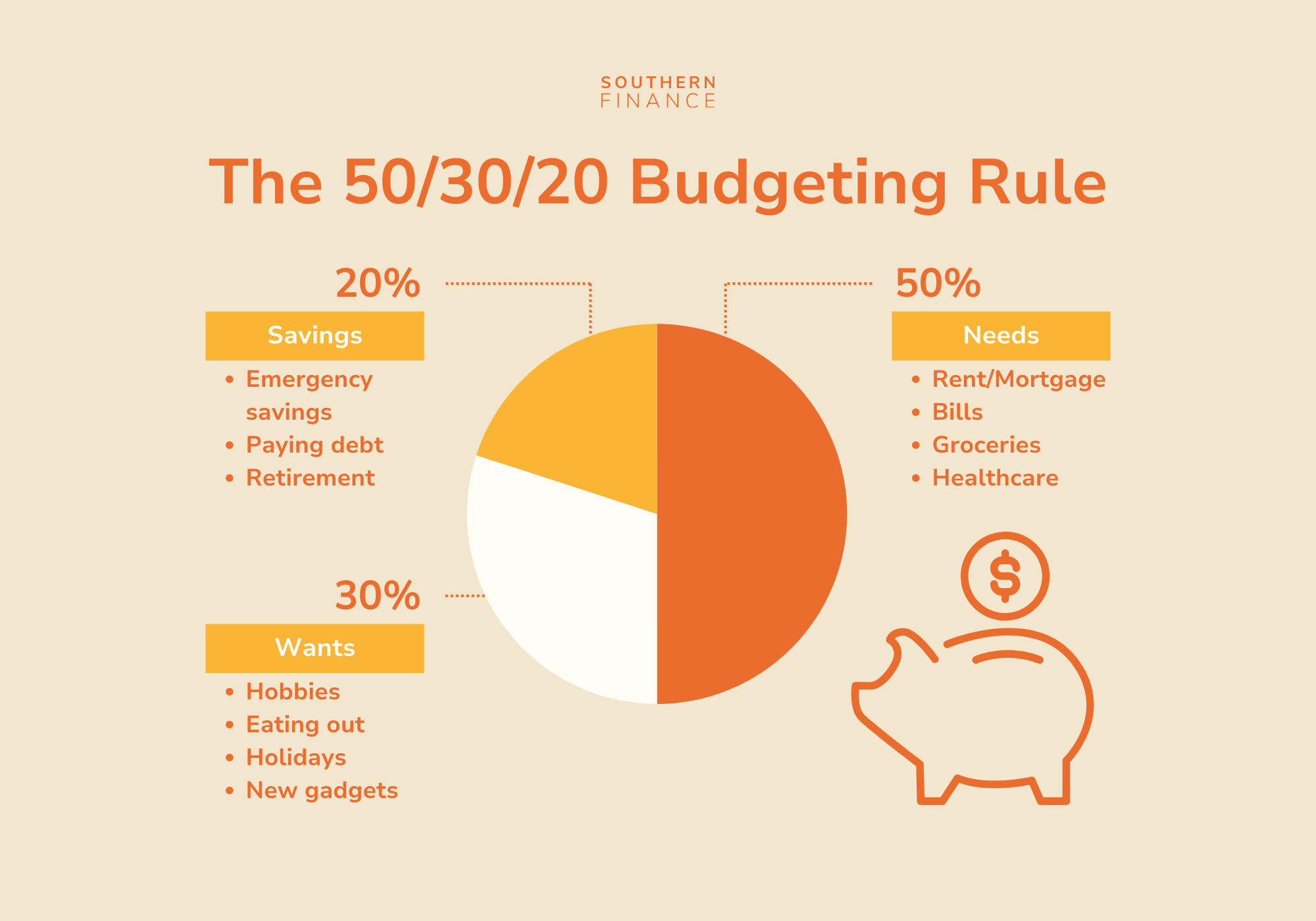

When times are tough, every little bit of money you save is important. The 50/30/20 rule helps people just like you have a clearer idea of how to split their monthly income into three main categories - needs, wants, and savings - and increase their rainy day funds little by little.

Financial freedom is seen by many as an unattainable dream - but it doesn't have to be. Learn all you need to know about the 50/30/20 rule in our guide below:

What Is The 50/30/20 Rule?

At its core, the 50/30/20 budget rule is a framework to divide your monthly household income by, to help you easily achieve your savings goals. The rule is as follows:

50% Towards Needs

The biggest part of your income after taxes will always go towards your needs. This includes necessities and monthly expenses you cannot live without. Examples of essential expenses are:

- Rent/mortgage payments

- Utility bills

- Groceries

- Health insurance

- Car payments

- Minimal debt repayments (e.g. student loan debt, credit card payments, etc.)

Consider setting up automatic payments where possible, so you can always be sure you have enough money for your needs.

30% Towards Wants

This budgeting framework suggests that 30% of your income should go towards your wants - that is, things you spend money on that are not absolutely essential to your survival. Wants are those extra expenses that make life more enjoyable, including but not limited to:

- Non-essential clothing and accessories

- Luxury items

- Ordering takeaway/eating out

- Holidays and non-essential travel

- Non-essential electronic items

- Gym memberships

- Purchases related to your hobbies

Even when times are tough, you might still want to spend some of your income on non-essentials that bring you joy. However, it is worth considering where you could cut costs, so you can get the same enjoyment at a lower price tag. Some of our tips are:

- Watching sports on TV at home instead of buying tickets to the game

- Cooking your favourite takeaway meal instead of ordering takeaway

- Avoiding buying the latest model for gadgets such as mobile phones or TVs

20% Towards Savings

Your savings serve as an emergency fund, which you can use to cover unexpected expenses or debt. Having a good amount of savings is very important not just as a financial goal, but also for your peace of mind.

Examples of savings are:

- Emergency savings

- Saving for a down payment for a house/car

- Retirement account savings

While the budget plan specifies that 20% of your income should go towards savings, it's not always so clear-cut. Instead, you should aim to put any leftover income into your savings, as every little bit will help in the long run.

Even more, any additional income you receive (either through working overtime, selling unwanted household items, or gifts) should always go towards your savings - your future self will thank you.

The Benefits of the 50/30/20 Rule

The 50-30-20 budgeting rule is more than just a formula - it is a way to gain more control over your spending and stay aware of exactly where your money is going. Following this budgeting rule:

Helps You Achieve Your Savings Goals

According to Standard Bank data, 29% of high-income earners in South Africa have less than one month's expenses in their savings accounts.

As a general rule, you should always have at least 3 to 6 months of living expenses saved up. This can help you get out of tough situations such as sudden job loss, escalating debt, medical emergencies or any other unforeseen circumstances.

Always remember - don't feel bad if you cannot save exactly 20% of your income every month, as even a small amount matters.

Is Easy To Use

The 50/30/20 rule follows a simple formula, and you don't need to be a financial guru to learn how to use it. It is easy to understand and you can readily apply it to your real-life income without needing to do intricate calculations.

Improves Money Management

Your necessities generally stay the same month to month, but the amount you spend on your wants may differ. It's not always easy to stay fully aware of exactly where all the money is going, but following a framework like the 50/30/20 rule can help you keep track of your spending.

By assessing your spending habits, you may discover that you are overpaying for services you don't use, or that there are cheaper alternatives to some of your wants. In the long term, your money management skills will improve, which can help you deal with unexpected money-related problems quickly and without anxiety.

Leads To Long-Term Financial Security

With the right money-saving approach, you can slowly but surely work towards future goals whether that's buying a new home, paying off a debt, or just building a secure emergency fund. The feeling of financial security will be priceless.

Can The 50/30/20 Rule Help You Lower Debt?

The short answer is - yes. If you stick to this simple budgeting method each month, you will be able to lower your debt little by little. However, it's worth mentioning that the 50/30/20 rule is not a means to pay off large amounts of debt at once, but rather a framework to live your life month by month and slowly achieve financial freedom.

If you need help covering high urgent costs, a short-term loan for debt consolidation might be a preferable option. Short-term loans:

- May offer lower interest rates

- May lower your monthly payments

- Can simplify your monthly payments

At Southern Finance, we provide convenient short-term loans with no hidden costs, so you can take financial matters into your own hands and achieve your goals. Simply use our loan calculator slider to see how much you can afford to borrow and get started today!