Short-term loans vs Long term loans - which one is better

When looking to gain access to funds and work towards reaching your financial goals, there are two loan types to consider:

- Short-term loans

- Long-term loans

In this guide, we'll explain the main differences between the two so you can make an informed decision that sets you up for success.

What Is A Short-Term Loan?

Just like the name suggests, short-term loans (or payday loans) are a type of loan usually taken out for a short period (typically less than a year). This loan is designed to give borrowers access to a large sum of money immediately and is a perfect fit for those who need money urgently.

Typically, you can access short-term personal loans through banks, credit unions, or reputable online short-term loan providers. The application process for this type of loan are also quite convenient, requiring minimal paperwork.

What Are Short-Term Loans Used For?

Usually, short-term loans are the ideal solution for those in need of urgent financial support. This can either mean:

- Unexpected expenses such as home or car repairs

- Medical emergencies

- Covering a huge purchase

- Making ends meet

Due to the nature of this loan, you can borrow a smaller amount over a short period of time, allowing you to deal with any emergency and pay the money back at a later date.

Short-Term Loans - Pros and Cons

| Pros: | Cons: |

|---|---|

| You gain quick access to cash, helping you deal with difficult situations | Higher monthly repayments - you are spreading your debt over a shorter period of time, meaning you will need to make sure you have enough money each month to cover the costs |

| Less interest - even if the interest rates are higher on a short-term business loan, you will be repaying your loan over a shorter period of time. In the end, you will be repaying a smaller amount of money. | Limited borrowing amount - the loan amount you can borrow is influenced by various factors, including income and credit score |

| Short-term commitment - you don't get tied to repayments over a long period of time |

What Is A Long-Term Loan?

On the other end of the spectrum, we've got long-term loans. These types of loans provide access to long-term financing - meaning you'll be able to borrow more money over longer periods of time. This can be any period of time from over a year to as long as 30 years.

Because you are repaying your loan over years or even decades, the monthly instalments will be lower than those of a short-term loan.

What Are Long-Term Loans Used For?

Generally, people use long-term personal loans for large purchases and significant financial commitments. This can be a home renovation, buying a new home, a new car, or even paying for a wedding.

Long-term loans can also be used for debt consolidation - that is, combining multiple debts into a single monthly repayment. However, this option might result in paying more money overall by the end of your repayment period.

Long-Term Loans - Pros and Cons

| Pros: | Cons: |

|---|---|

| Extended repayment periods | Higher amount of money paid overall, due to long repayment period |

| Lower monthly payments due to spreading debt over longer periods of time, which can help you afford to borrow more money | Long-term commitment |

| Lower interest rates |

Which Is Better - A Long-Term Loan Or A Short-Term Loan?

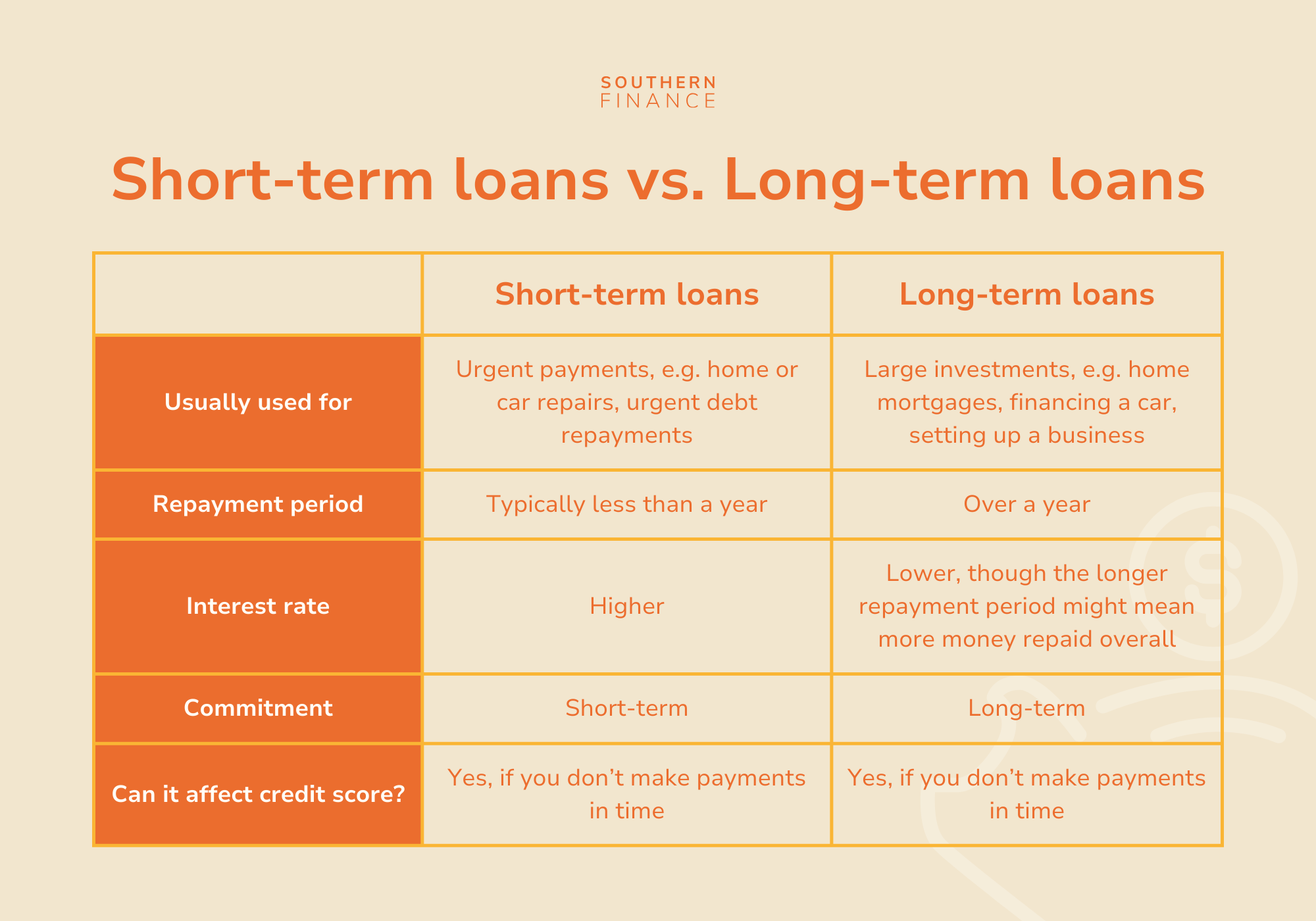

When choosing between short-term and long-term loans, first you need to consider your goals. If you are in need of urgent cash (e.g. to do home or car repairs), a short-term loan can help provide the funds to deal with your situation quickly. Long-term loans are usually better suited for larger investments, such as a mortgage, buying a new car, or setting up a business.

To make the best decision for your specific needs, you should also consider the specific loan terms you're signing up for. We're talking about factors such as:

Interest Rates

Short-term loans tend to have higher interest rates than long-term loans. That is because a shorter repayment period poses a higher risk to the lender, while a long-term loan is usually associated with a lower risk. The exact interest rates and loan repayment values will differ from one loan provider to another, so make sure to compare a few before making a decision.

Overall Cost Of Borrowing

However, interest rates are not the only thing to consider. Higher interest rates simply mean your monthly repayments might be slightly higher, so you need to carefully consider if you can afford those payments every month until the debt is paid off.

Long-term loans are more affordable at first glance due to lower interest and thus lower monthly repayments. However, you will be paying for a much longer time, meaning the interest will accumulate at a much higher rate.

Start Your Journey Towards Financial Freedom

Long-term loans are suitable for large investments such as financing a new home or a new car. However, if you require urgent financial help, short-term loans offer a lot more flexibility without signing you up for a long-term commitment.

Southern Finance offers short-term loans that help you get through difficult financial situations, with no hidden costs or terms. Use our slider calculator to see how much you can borrow today!