All About Money Stress And How to Avoid It

Feeling overwhelmed by money stress? You're not alone. Many people deal with financial uncertainty from time to time, while for others it is a constant reality.

No matter your circumstances, there are many ways to cope with money-related anxiety and get through difficult times - read our guide below to learn how to avoid money stress.

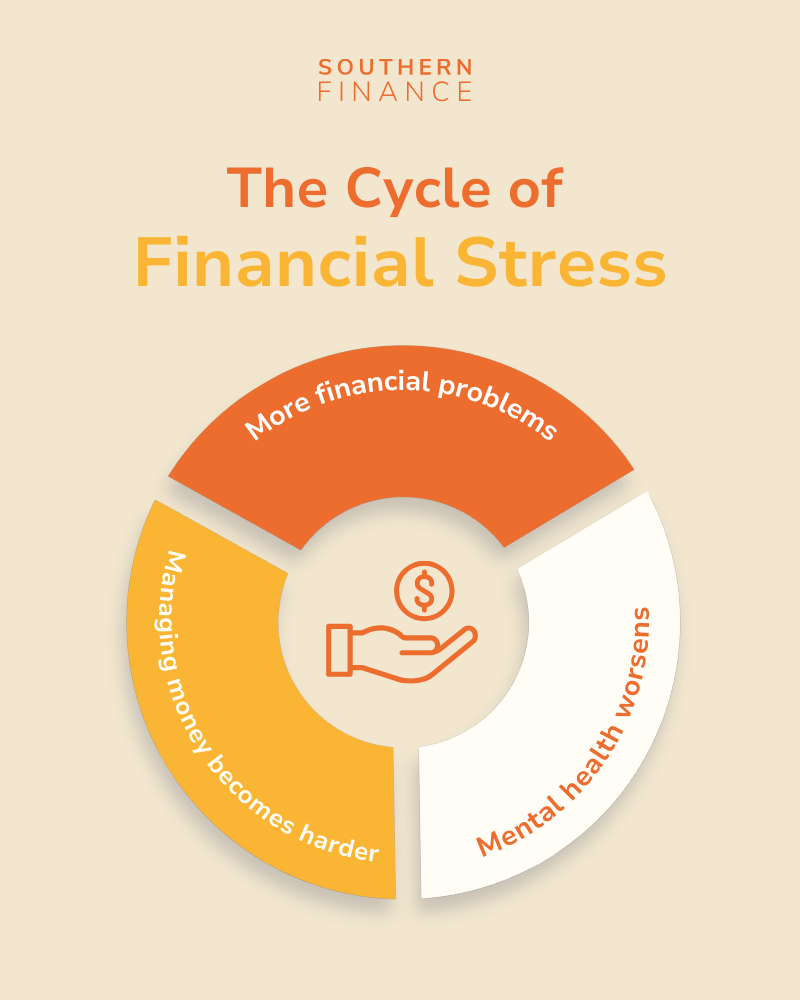

The Effects of Financial Stress

Trying to keep your finances in order can cause a lot of stress, especially when dealing with unemployment, high debt, and unexpected expenses. Factors such as increasing living costs in the South African market, food prices, and unaffordable housing can make matters even worse. According to a 2023 survey by Sanlam Benchmark, 87% of South Africans reported dealing with financial stress, revealing a bleak reality of today's economy.

Many people might not realise just how big of an impact money worries can have on your life. Financial stress can lead to:

Financial Anxiety and Depression

Money stress is often named as the first cause of people's mental health issues.

If you've recently lost your job or are dealing with escalating debt, it's easy to end up feeling hopeless and depressed. For some people, this may also mean self-harming or suicidal thoughts. Constantly worrying about all the worst-case scenarios can also lead to even more stress and even panic attacks.

Low Self-Esteem

Struggling with money can often feel like a personal failure, even though it is not the case. When debt starts accumulating, you might start to feel flawed, like you are not good enough. Poor self-esteem not only worsens your mental health, but can greatly affect your relationship with your partner, friends, and family.

Unhealthy Coping Mechanisms

When under high levels of stress, we tend to seek coping mechanisms - some people might turn to stress-eating, drinking, gambling, or even drugs, which will not only affect your mental state and body but also exacerbate your financial struggles.

Relationship Difficulties

Nothing leads to more arguments in your home than money worries. Stress can lead to a short temper, irritability, and even anger - if this mood persists over long periods of time, it can definitely have an impact on even the strongest relationships.

Physical Health Issues

When all the stress accumulates in your body, it can lead to various health issues, including but not limited to insomnia, chronic migraines, digestive issues, high blood pressure, and even heart disease.

5 Ways to Handle Money Stress

Managing your finances requires a multifaceted strategy, from budgeting techniques to ways to manage stress levels in healthy, sustainable ways. It's important to remember that there is always a solution and that you don't have to face your struggles by yourself.

Here are 5 ways to improve your life and keep your finances in order:

- Talk To Someone

- Assess Your Current Finances

- Make A Plan

- Too much debt (credit card debt etc.)

- Low income

- Lots of unnecessary purchases

- A combination of issues

- Improve your financial situation short-term - discuss with your credit card company to request a lower interest rate, discuss the possibility of overtime with your boss, sell unused household items, or take out a short-term loan for debt consolidation

- Improve your financial situation long-term - network for a new job with higher pay, build savings, find cheaper alternatives to leisure purchases

- Create a budget

- Rent/mortgage

- Utilities

- Costs of commuting to work

- Groceries

- Unexpected expenses

- Create an emergency fund

Money stress leads to lots of negative feelings, and many people tend to bottle everything up, withdrawing themselves from their loved ones. This can be especially true if they feel ashamed of their mistakes and fear judgment from family and friends.

However, simply opening up to someone can lift a weight off your shoulders, no matter if you're looking for solutions or just venting. Talking about your situation might help put things into perspective, and even help you come up with solutions you hadn't thought of before. You might also realise that those close to you share your concerns and even relate to your money situation.

Even if they don't fully relate, your loved ones still want to help ease your burden without judgment.

Speaking to a licensed therapist can also help you learn how to cope with your stress and other mental health challenges in a healthy way.

The first step to getting back on track is assessing your current financial situation.

Check any pending bills and bank and credit card statements, and try to identify any spending patterns - this can mean anything from subscriptions you don't use to lots of takeaways and impulse shopping. By reducing some of your non-essential expenses, you might reduce your stress levels and even build some savings over a short period of time.

Always remember to be kind to yourself, as anyone can find themselves in financial difficulty with no warning.

Assessing your financial situation will help you identify potential issues, so you can make a plan to tackle each. Some of the issues one might face are:

Every circumstance comes with its own issues and requires specific solutions. Here are a few things you can do to:

Until you can increase your income, a great way to alleviate money stress and get extra peace of mind is to create a budget and try to stick to it. This can be a monthly, weekly, and even daily budget, split into relevant categories such as:

A popular strategy for budgeting nowadays is the 50/30/20 financial plan. The name of this strategy comes from how you should split your income as follows: 50% of your income should go towards needs (rent, utilities, etc.), 30% should go towards wants, and 20% towards savings.

Make sure to set automatic payments for your bills - this will ensure you make payments on time but also help you stick to your budget.

Once you figure out how much of your income goes towards necessities, you can come up with a realistic strategy to grow your emergency fund. Whether you're following the 50/30/20 rule or setting aside a set amount each month, growing your savings bit by bit will help alleviate some of your financial worries.

At first, prioritise saving up to three-six months of living expenses in case of emergency, before you start looking at longer-term savings goals. We recommend setting up automatic transfers from your bank account to your savings account, so you can make sure you stick to your goals no matter what.

Always remember that, during difficult times, you may find it hard to meet your savings goals every month - it's important not to get overwhelmed, and remember that even the smallest amount of money saved matters.

Avoid Money Stress With Southern Finance

Financial struggles are not a reflection of who you are and are also not unfixable. With the right budgeting techniques and healthy stress management, you can take life back into your hands and reach your financial goals.

Need a hand to help deal with sudden expenses? Southern Finance provides short-term loans at low interest rates, so you can deal with any financial challenges right away and pay back the money when you are in a better financial state. Use our loan calculator to see how much you can afford, and apply for a payday loan today!